massachusetts estate tax return due date

A request for an extension of time to pay should be submitted for review. The estate tax return is due 9 months after the date of death.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

The date of death and any tax due must be paid at that time.

. Failure to file this return within the nine months or within the approved extension period can attract these penalties. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax. DOR 2021 paper returns are available.

Supplemental forms such as 706-A 706-GS D-1 706-NA or 706-QDT may also need to be filed. If youre responsible for the estate of someone who died you may need to file an estate tax return. Estate tax returns and payments are due 9 months after the date of the decedents death.

Massachusetts requires estate tax returns to be filed within nine months following a death. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. Note that the table below is for estate income tax returns Form 1041 not estate tax returns Form 706.

The filing of the gift tax return occurs only if the decedent gave a gift of over 1500000 in value prior to the date of death. The Massachusetts estate tax is not portable between couples. As of 2016 if the executor pays at least 80 of the estate tax due before the deadline there will be an automatic 6.

The due date for filing the estate tax returns is nine months from the decedents death. The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will only owe estate taxes if its value is greater than that threshold. Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines Only to be used prior to the due date of the M-706 or on a valid Extension Revised April 2020.

Third installment is due on or before September 15 2022. December 31 2000 see Massachusetts Estate Tax Return Form M-706. Late Filing Penalty - 1 percent per month or fraction thereof to a maximum of 25 percent of the tax as finally determined to be due.

Form 706 must generally be filed along with any tax due within nine months of the decedents date of death. For dates of death on or after January 1 2006 the personal representative of a decedent who was a domiciliary of Massachusetts must file a Massachusetts Estate Tax Return Form M-706 if the gross value of an estate plus adjusted taxable gifts exceeds the applicable exclusion amount of 1000000. We last updated the Estate Tax Return in April 2022 so this is the latest version of Form M-706 fully updated for tax year 2021.

Note that it is also possible to get a six-month extension of time to file these returns although if there is a tax due an estimated tax will generally have to be paid within the original nine-month deadline Evaluating the Estate. Second installment is due on or before June 15 2022. Only about one in twelve estate income tax returns are due on April 15.

The return must be filed and the tax paid within 9 months from the date of your death. 4 Gift Taxes Form 709. Form 706 July 1999 revision.

The Tax Relief Unemployment Insurance Reauthorization and Jobs Creation Act of 2010 which raised the federal exemption from estate taxes to. In general if the decedent earned enough income in the final year of life to require filing final income tax returns the final returns for a calendar year taxpayer are due on April 15th following the year of death. Due Date of Massachusetts Estate Tax Return Form M-706 Form M-706 Estate Tax Return is due within nine months after the date of the decedents death.

Its worth noting that if at least 80 percent of the tax finally determined to be due is not paid. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. Massachusetts legislative leaders said Thursday they plan to extend the states tax-filing deadline by roughly a month to align with changes at the federal level giving taxpayers more time to file.

The estimated amount of tax to be paid found on Line 4 Part 2 of Form M-4768 must be paid in full. Personal representative of the estate or Any person in actual possession of the decedents property. 3 However not every estate needs to file Form 706.

When to File Generally the estate tax return is due nine months after the date of death. The Massachusetts estate tax for a resident decedent generally is the Credit for State Death Taxes number shown on Line 15 of the July 1999 Form 706 see Form M-706 Part 1. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

The gift tax return is due on April 15th following the year in which the gift is made. Up to 25 cash back Deadlines for Filing the Massachusetts Estate Tax Return If a return is required its due nine months after the date of death. The estate tax exemption is 117 million for 2021 and rises to 1206 in 2022.

Form 2-ES Estimated First installment is due on or before April 19 2022. US Estate Tax Return Form 706 Rev. How to file Contact.

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect. According to IRS data the number of processed tax returns on a year-over-year basis was down 114 percent as of June 19. How much estate tax will my estate have to pay.

Estate tax returns must be filed by the. The federal estate tax has a much higher exemption level than the Massachusetts estate tax. Fourth installment is due on or before January 15 2023.

Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will probably say that the Form 1041 is due on April 15. You can however apply for an extension by submitting Form M-4768. However confusion sets in when the decedent died after the close of the tax year but before the filing of the prior year income.

If your taxable estate including any taxable gifts made during your lifetime totals 1 million or more your estate must file a Massachusetts estate tax return and you may owe Massachusetts estate tax. DOR prior year returns are available. The gift tax return is due on or before April 15th after the year the gift was made.

The Massachusetts estate tax is calculated by. Even then only the portion of the estate that exceeds 1158 million will be taxed at a maximum rate of 40 percent. Staple check here language removed from form Form M-4768 Massachusetts Estate Tax Extension Application US.

When both spouses die only one exemption is applied to the estate. Here is the rate. It depends on the value of the estate.

If the executor doesnt file a required estate tax return return within nine 9 months from the date of death or within an approved period of extension he or she will have to pay a penalty. The Application for Extension of Time to File Massachusetts Estate Tax Return Form M-4768 must be filed prior to the due date for the M-706. Specific Information An extension of time to file will be granted automatically for a period of six months.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Eight Things You Need To Know About The Death Tax Before You Die

How Much Is Inheritance Tax Community Tax

When To File Form 1041 H R Block

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Michigan Real Estate Power Of Attorney Form Power Of Attorney Form Power Of Attorney Power

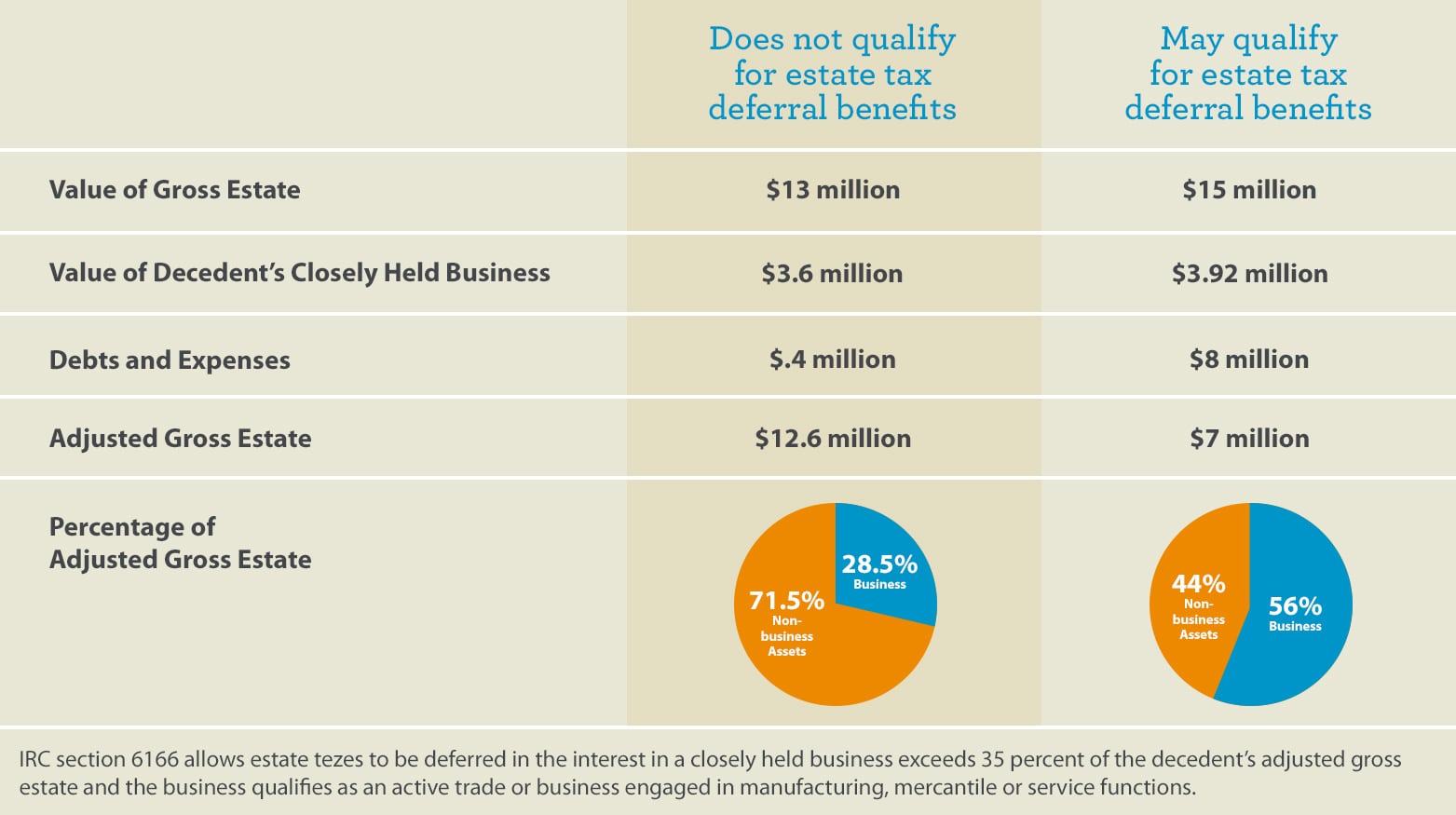

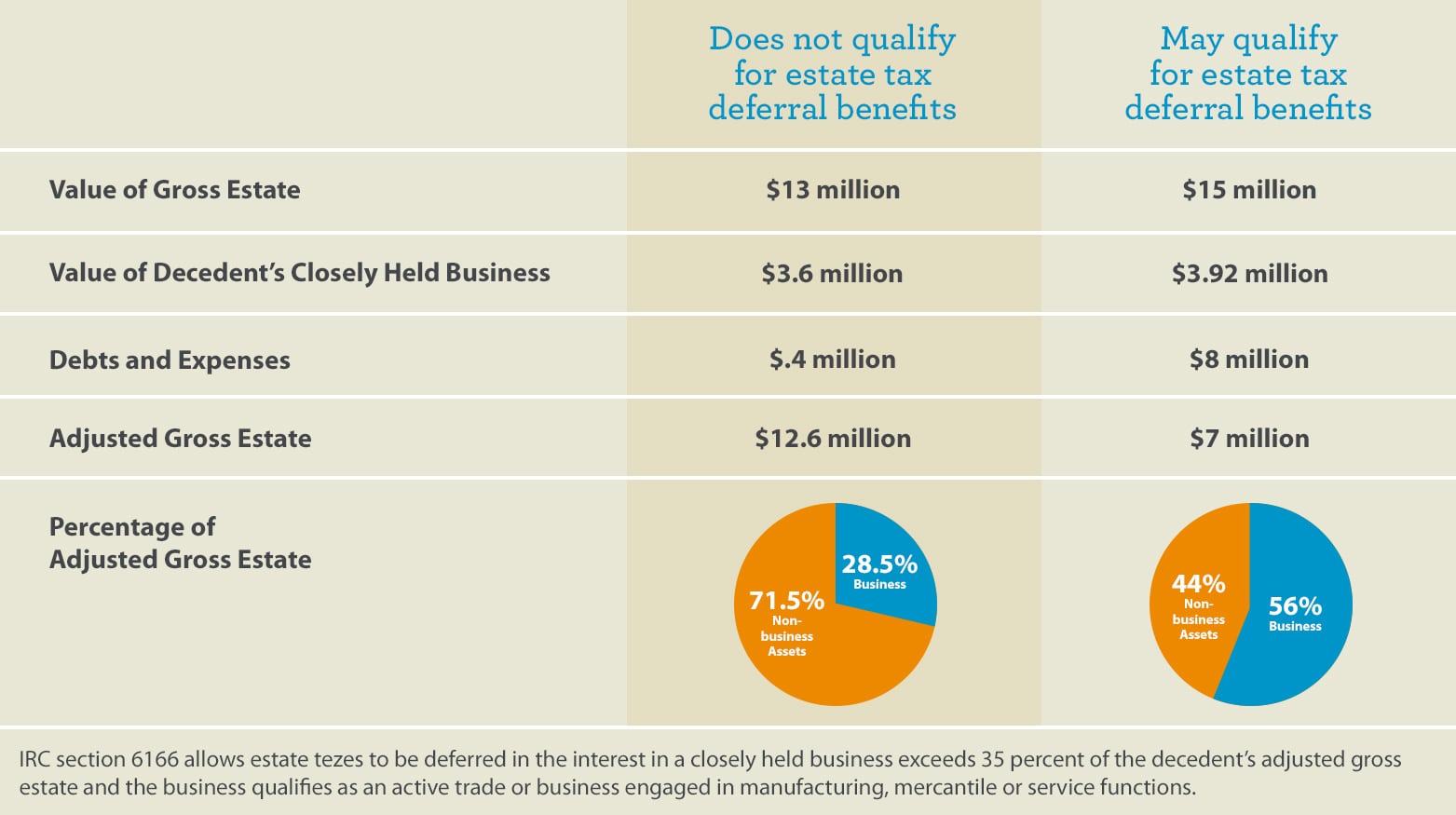

Estate Taxes On A Closely Held Business Under Irc 6166 Wells Fargo Conversations

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Should You Elect The Alternate Valuation Date For Estate Tax

Understanding Qualified Domestic Trusts And Portability

New Irs Requirements To Request Estate Closing Letter

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service