s corp tax calculator nyc

S-Corp or LLC making 2553 election. Partnership Sole Proprietorship LLC.

New York City Taxes A Quick Primer For Businesses

New York Estate Tax.

. If your company is taxed at a high level try our S Corp tax savings calculator. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax.

A What is your. Being Taxed as an S-Corp Versus LLC. New York Estate Tax.

See TSB-M-15 7C 6I for additional. The SE tax rate for business owners is 153 tax. Rate in Tax Year 2015 and thereafter.

Free shipping on qualified orders. Ad We Simplify The Process And Keep It Industry-Specific So You Can File Taxes w Confidence. C-Corp or LLC making 8832 election.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Not more than 100000. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Ad Easy To Run Payroll Get Set Up Running in Minutes. Taxes Paid Filed - 100 Guarantee. This could potentially increase the S-corp tax bill significantly and.

Free easy returns on millions of items. Ad Browse discover thousands of unique brands. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

However if you elect to. The portion of total business capital directly. How s corporations help save money.

Taxes Paid Filed - 100 Guarantee. Check each option youd like to calculate for. See S corporations - tax years beginning before January 1 2015 for S corporation information for years prior to corporate tax reform.

New Yorks estate tax is based on a. Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. Cooperative housing corporations 04.

For example if you have a. Ad Easy To Run Payroll Get Set Up Running in Minutes. Read customer reviews best sellers.

If your business is incorporated in New York State or does. 1 Select an answer for each question below and we will calculate your S-corp tax savings. All other corporations 15.

Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction.

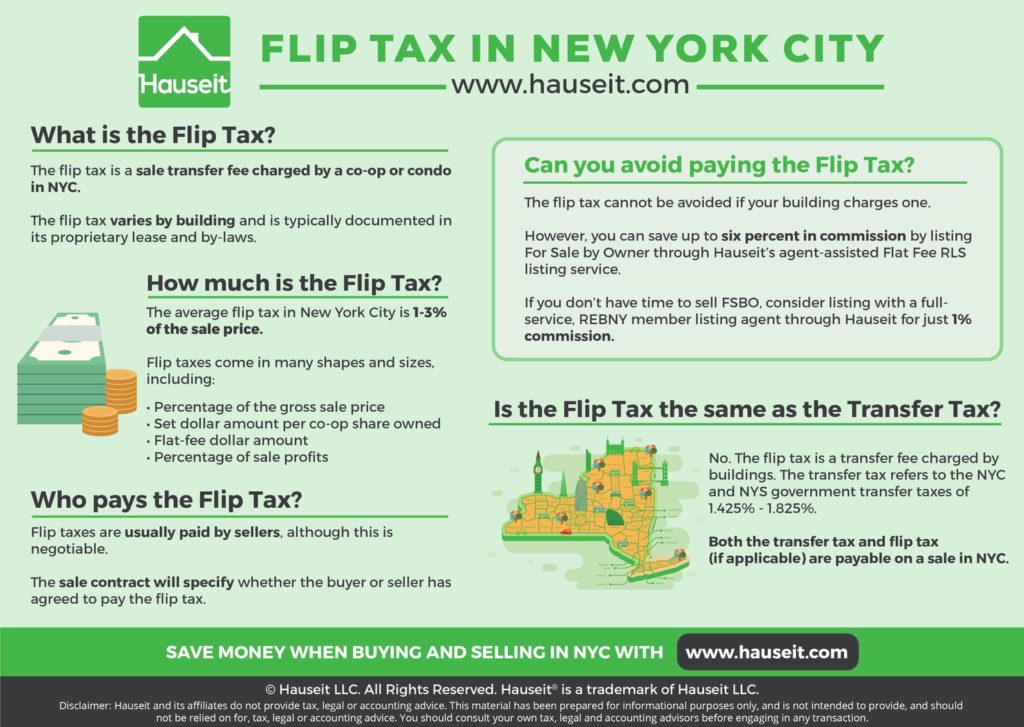

Flip Tax In Nyc What Is The Average Flip Tax And Who Pays It Hauseit

New York City Taxes A Quick Primer For Businesses

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

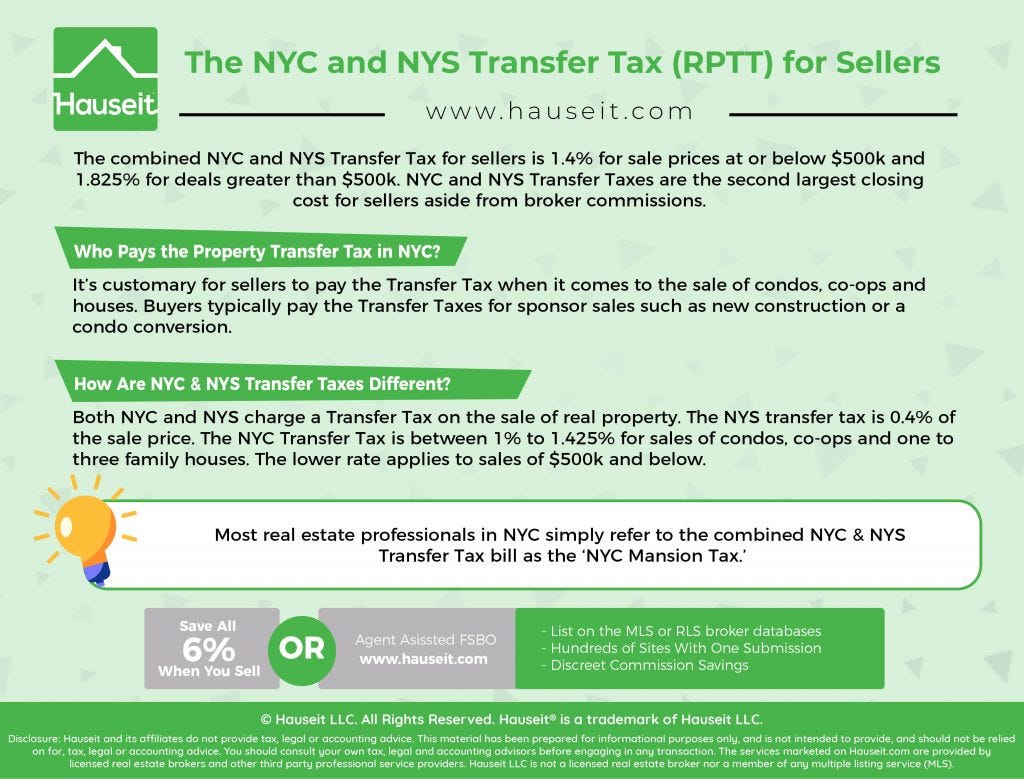

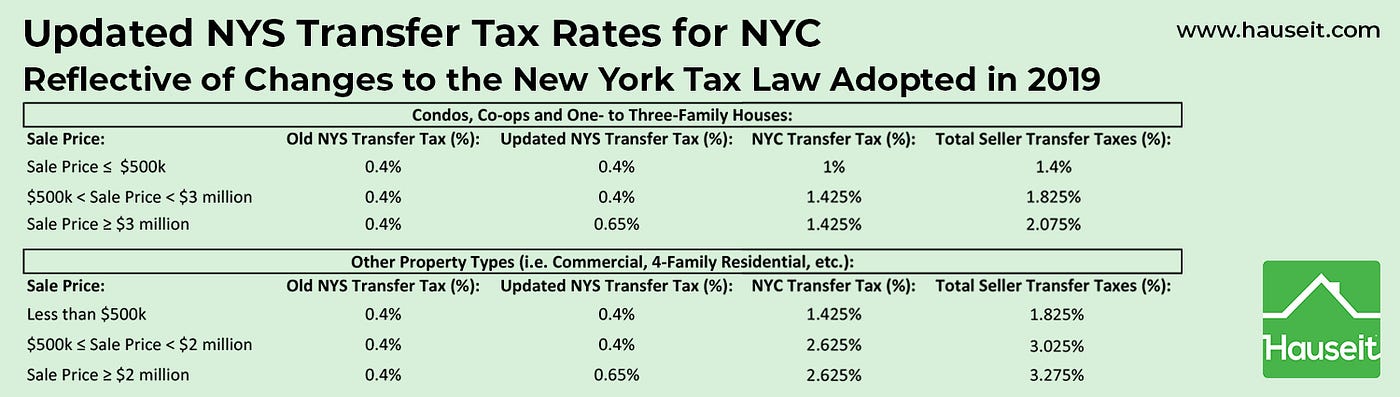

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

Ny State And City Payment Frequently Asked Questions

Right Of First Refusal Work In Nyc Hauseit Right Of First Refusal Buying A Condo Nyc

Ny State And City Payment Frequently Asked Questions

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

My Nyc Employer Will Pay Me 10k Relocation Money How Much Of It Will Be Withheld For Tax Purposes Quora

The Best Working Tax Credit Number This Was The Best Support Number We Could Find For The Working Tax Credit Customer Service Work Tax Credits Tax Credits

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium

How Much Will I Have To Pay In Taxes As An Intern In New York City Quora

New York State Enacts Tax Increases In Budget Grant Thornton